FIRST NATIONAL BANK ROUTING NUMBERS

Review below list of FIRST NATIONAL BANK routing numbers with branch and city details. Click on the individual routing number for more details. first national bank uses different code for its different banking service. Make sure to check your routing number with recipient or bank before starting your money transfer. Cross checking provided routing number directly with your recipient bank is highly recommanded.

FIRST NATIONAL BANK ROUTING NUMBERS

| City | Address | Routing Number |

|---|---|---|

| BELLEVUE | 120 NORTH ST. | 041204726 |

| LONDON | 202 SOUTH MAIN STREET | 042102270 |

| JACKSON | 1126 MAIN STREET | 042102571 |

| GRAYSON | 200 SOUTH CAROL MALONE BLVD | 042103473 |

| MANCHESTER | 120 TOWN SQUARE | 042105442 |

| BLANCHESTER | 121 EAST MAIN STREET | 042206422 |

| GERMANTOWN | 17 NORTH MAIN STREET | 042206503 |

| NEW BREMEN | P.O. BOX 68 | 042306720 |

| MCCONNELSVILLE | 86 N. KENNEBEC AVE. | 044106384 |

| WAVERLY | P.O. BOX 147 | 044206475 |

| ALTAVISTA | P O BOX 29 | 051403041 |

| WAYNESBORO | 626 LIBERTY STREET | 061202245 |

| MOUNT DORA | 3000 HWY 19A | 063104312 |

| PULASKI | PO BOX 289 | 064101194 |

| MANCHESTER | P.O. BOX 989 | 064102371 |

| PULASKI | PO BOX 289 | 064107994 |

| HELENWOOD | P.O. BOX 950 | 064204444 |

| PICAYUNE | 121 E. CANAL STREET | 065505870 |

| WAVERLY | 316 EAST BREMER AVENUE | 073902766 |

| MANNING | PO BOX 325 | 073904890 |

| PRIMGHAR | PO BOX 68 | 073907855 |

| SHENANDOAH | 801 S. FREMONT | 073910237 |

| REMBRANDT | 101 EAST MAIN ST | 073915520 |

| WAVERLY | 316 E BREMER AVE | 073922940 |

| CLOVERDALE | 302 S MAIN STREET | 074907126 |

Understanding Routing Number

A routing number is a nine-digit code to identify a financial institution in a transaction. It is also known as an ABA (American Bankers Association) routing number. Each bank or credit union is assigned a unique routing number to facilitate the routing of checks and electronic transactions, such as direct deposits, wire transfers, and automatic bill payments.

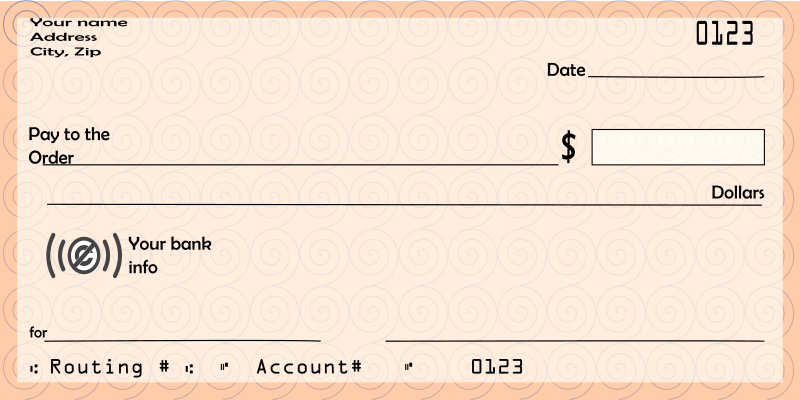

The routing number is typically found at the bottom left corner of a check, and it is preceded by the bank's or credit union's fractional routing number. The routing number is essential for ensuring that funds are directed to the correct financial institution during transactions. It's important to note that the routing number is different from an account number, which identifies the specific account within the institution.

If you need to provide your routing number for a transaction, it's crucial to use the correct one to avoid any errors in the processing of your financial transactions.

Benefits of Routing Number

Routing numbers play a crucial role in facilitating various financial transactions within the United States. Here are some of the key benefits of routing numbers:

- Identification of Financial Institutions: Routing numbers uniquely identify each financial institution in the U.S. This helps in the smooth and accurate processing of financial transactions.

- Check Processing : Routing numbers are used on checks to indicate the financial institution from which the funds are drawn. This helps in the efficient sorting and processing of checks during the clearing process.

- Direct Deposit : Employees and individuals who receive direct deposit payments, such as salaries, pensions, or government benefits, need to provide their routing number. This ensures that the funds are correctly deposited into the designated bank account.

- Wire Transfers : Routing numbers are essential for initiating wire transfers. They help in directing funds to the correct financial institution and account.

- Automatic Bill Payments : When setting up automatic bill payments, individuals provide their routing number along with their account number. This ensures that the payments are correctly withdrawn from the specified account.

- ACH Transactions : The Automated Clearing House (ACH) network, which handles electronic transactions like direct deposits and electronic funds transfers, relies on routing numbers to route funds between banks.

- Mobile and Online Banking : Routing numbers are used in online and mobile banking for various transactions, including transferring funds between accounts and linking external accounts.

- Account Verification : Routing numbers can be used to verify the legitimacy of a financial institution and the associated account when setting up new payment relationships or verifying account information.

- Loan Payments : When making loan payments, borrowers may need to provide their routing number to ensure that payments are correctly applied to their loan accounts.

In summary, routing numbers are a fundamental component of the U.S. financial system, enabling the accurate and secure transfer of funds between different banks and credit unions. They play a crucial role in various financial processes, making transactions more efficient and reliable.

To find a routing number, select your state, bank, and city using the above routing number finder. Alternatively, you can browse all routing number for a particular bank.

Routing Number example : XXXXYYYYC

XXXX - The first four digits (XXXX) represent the Federal Reserve Routing Symbol.

YYYY - The next four digits (YYYY) are the ABA institution identifier.

C - The last digit (C) is what’s called a check digit that is used to prevent transaction errors.

Remember, this is just a fictional example, and real routing numbers will differ based on the specific bank and its location. Always refer to your actual checks, bank statements, or contact your bank to obtain the correct routing number for your transactions.

Routing Number - Frequently Asked Questions(FAQ)